Getty Images

Getty ImagesInterest rates are widely expected to be cut by the Bank of England on Thursday, in a move closely watched by businesses and consumers.

Most analysts predict that the benchmark rate will fall from its current level of 5% to 4.75% when the decision is announced at 12:00 GMT.

That would make borrowing money cheaper, but is likely to reduce the returns available to savers.

The Bank’s Monetary Policy Committee (MPC) meets eight times a year to set rates.

Bank of England expectation

The Bank of England cut interest rates from 5.25% to 5% in August, which was the first drop in more than four years following a string of increases.

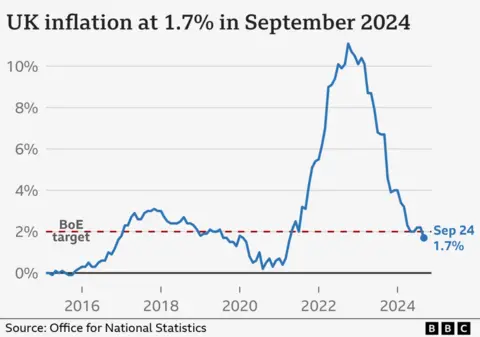

Since then, official figures have revealed that the UK inflation rate – which charts the rising cost of living – dropped unexpectedly to 1.7% in September.

That was the lowest rate for three-and-a-half years and below the 2% target set by the government. Interest rates are the main tool for the Bank to control the level of inflation.

Subsequent figures from the Office for National Statistics (ONS) showed that wage growth slowed to its lowest pace for more than two years.

That gave more impetus to the likelihood of a Bank rate cut.

Bank Governor Andrew Bailey also told the Guardian last month that it could be a “bit more aggressive” at cutting borrowing costs, depending on the rate of inflation.

How it affects borrowers and savers

The Bank’s base interest rate heavily influences the rates High Street banks and other money lenders charge customers for loans, as well as credit cards.

Lenders have mostly “priced in” the impact of a base rate cut when making decisions on their own interest rates.

Mortgage rates are still much higher than they have been for much of the past decade. The average two-year fixed mortgage rate is 5.4%, according to financial information company Moneyfacts. A five-year deal has an average rate of 5.11%.

However, more than one million borrowers on tracker and variable deals could see an immediate fall in their monthly repayments if the Bank cuts rates.

Savers would likely see a reduction in the returns offered by banks and building societies. The current average rate for an easy access account is about 3% a year.

Rachel Springall, of Moneyfacts, said: “Savers are the ones who feel the force of cuts to interest rates. Those savers who use their interest to supplement their income will feel overlooked if rates plummet.”

Budget and US election impact

Political events will feed into the Bank’s decision on Thursday, specifically last week’s Budget delivered by Chancellor Rachel Reeves, and Donald Trump’s sweep to victory.

The government’s official, but independent, forecaster – the Office for Budget Responsibility – said, in the short term, measures announced in the Budget would push inflation and interest rates higher than they would otherwise have been.

This has created more doubt about whether the Bank of England will cut interest rates again following its meeting in December.

Meanwhile, analysts’ forecasts suggest US inflation will be higher under the expectation that Trump will introduce higher tariffs on all imports next year.

This would give the Federal Reserve less scope to ease interest rates, and could affect decisions made around the world, they said.

What are my savings options?

- As a saver, you can shop around for the best account for you

- Loyalty often doesn’t pay, because old savings accounts have among the worst interest rates

- Savings products are offered by a range of providers, not just the big banks

- The best deal is not the same for everyone – it depends on your circumstances

- Higher interest rates are offered if you lock your money away for longer, but that will not suit everyone’s lifestyle

- Charities say it is important to try to keep some savings, however tight your budget, to help cover any unexpected costs

There is a guide to different savings accounts, and what to think about on the government-backed, independent MoneyHelper website.

What are interest rates? A quick guide.