Business reporter

Getty Images

Getty ImagesWe have all heard of carmaker Ford, but what about its one-time rivals Abbot-Detroit, Acme, Adams and Aerocar?

No? Well that is hardly surprising because unlike Ford they all went bust very early on. And they are just some of the failed car companies starting with the letter “A”.

We only remember the winners who went on to dominate the world’s motor industry, and the current high-tech sector is much the same.

A great many investors backed the wrong horseless carriages around a century ago and lost their money. Only a few picked Ford or Chrysler, which is almost exactly what is happening now, only to the tech sector.

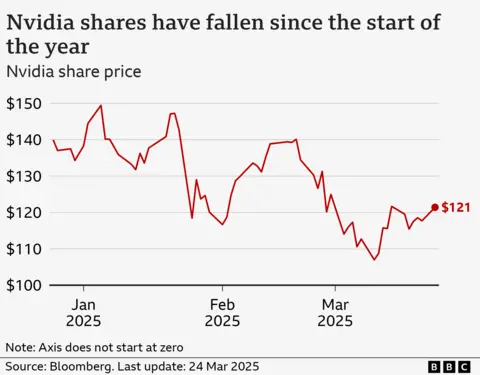

Tech shares have been hugely volatile over the past year, as has been widely reported, with share price graphs often looking like rollercoaster rides, even before President Trump’s tariffs have caused wider stocks falls.

A principle reason for this tech sector volatility, according to Elroy Dimson, professor of finance at the University of Cambridge, is that like the once nascent car industry we don’t know which tech firms will win in the long run.

“If you go back to the beginning of the last century there were an awful lot of motor companies, and it was clear that automobiles were going to make a huge difference,” says Prof Dimson. “But almost every company went bankrupt, you didn’t know which company you should be buying.”

Then, of course, not all high-tech businesses are making money. The measure of the return on an investment in shares uses two factors, the growth in profits or dividends, and the growth in the value of the shares.

Boring companies might pay reliable dividends and see their shares gradually increase in value. But many high-tech companies are not paying out much if anything in dividends. Instead, they are investing in future growth, and so their share prices fluctuate based on hopes of future profits.

As Susannah Streeter, head of money and markets at UK financial services firm Hargreaves Lansdown, puts it: “Tech shares are more volatile, they have high valuations and their price-earnings ratios are very high, and growth stocks are more sensitive to interest rate movements.”

But also, investors in such shares are, as Ms Streeter puts it, gambling on “not jam today but jam tomorrow”. They are all trying to pick the next future big winner, not the one paying out profits now, but the one that will eventually pay huge dividends sometime in the future.

So, any news or even suggestion that future growth is not going to be as good as previously expected means share values can collapse.

Susannah Streeter

Susannah StreeterOn the other hand, any good news boosts share prices even if current profits, or even losses, don’t change at all, as investors pile into what they think is the future winner. The shares are more volatile because they are not underwritten by current profits or dividends.

That means as Prof Dimson puts it, “that small changes in growth expectation can lead to large changes in share value”, which can effect a large number of companies at the same time.

“You have companies that are reasonably similar, so when growth rates change it is effecting quite a few companies in a similar way,” he says.

“This is not different from the dotcom boom at the beginning of the 2000s. There were companies with huge growth prospects. And when the growth prospects disappeared, these were the companies that disappeared.”

Also, even today there are not that many really large high-tech companies. In America they are colloquially known as the “magnificent seven” – Nvidia, a chipmaker, Alphabet, which owns Google, Amazon, Apple, Microsoft, Meta, the parent of Facebook, and Tesla.

So, it does not take much to spook the market, especially since several of these firms are really quite young, and are dominant in sectors where previous leaders have crashed and burned. Anyone remember Ericsson, Boo or Compaq?

Technology, unlike say steel production or food manufacturing, is changing at a very rapid rate, and there is obviously the chance that a new high-tech company will come along and destroy the business model of its most established rivals.

There is simply no guarantee that today’s “magnificent seven” will remain magnificent or even stay as the same seven firms.

Take Tesla for example, its sales have recently fallen in response to two widely-reported factors. Firstly, some potential customers are opposed to Tesla owner Elon Musk’s involvement in President Trump’s government. And secondly, Chinese electric car firms such as BYD are increasingly strong competitors.

Meanwhile, Nvidia saw its share price drop sharply at the start of this year following the release of Chinese artificial intelligence chatbot DeepSeek. This app was reportedly created at a fraction of the cost of its rivals.

The instant popularity of DeepSeek has raised questions about the future of America’s AI dominance and the scale of investments US firms are planning. This concerns Nvidia because it is at the forefront of making microchips for AI processing.

Getty Images

Getty ImagesAI is now the biggest tech game in town, and it seems that absolutely everyone is claiming that AI is transforming their industry, their products and their profits. They can’t all be right.

Or as Prof Dimon puts it: “At least in 1910 you knew what automobiles did, but today with AI companies you have to rely on the wisdom of the crowd, and for AI companies that isn’t good enough.”

And not all AI firms can win, adds Robert Whaley, professor of finance at Vanderbilt University in Tennessee. “AI is certainly contributing to tech volatility. The race is on.”

That means that AI shares are sensitive to predictions. And any sign that a particular firm is lagging in the AI race may mean that lots of investors, most of whom don’t understand the subject, abandon it for another that seems to be further ahead.

Then there are investors who seemingly don’t seem to care which companies’ shares they buy, so long as they are in the “booming” high-tech sector, as they are speculating and spreading their risks.

In short, share prices are not always a rational measure of a firm’s value, especially in the high-tech sector, or even of its prospects. Instead, they can represent the optimism of investors. And optimism does not always last.

It is often short-lived, passing, and faddish. And sometimes optimism comes face to face with reality or just plain fades away. It is, in short, volatile.